About East African Partners

At East African Partners, our goal is to help Uganda and East African countries thrive and compete globally.

With 45 million + people in Uganda alone and growing by the second. These nations desire full employment, support educational advancement, and offer a wealth of resources and opportunities to encourage partnerships from around the world.

The needs are vast. Industry, Agriculture, Hospitality, Infrastructure and Healthcare all represent significant areas of opportunity for international partners.

Our team is located in Uganda and the United States to facilitate fast connections for launching new partnerships quickly by cutting through layers of government bureaucracy.

International businesses have been flocking to Uganda and East African Countries because of the international friendly environment, abundance of resources, and central global location.

Reaching the right governmental departments and decision makers can often be challenging for outside companies. That’s where the EAP trans-continental teamwork comes in. Together, we bridge the culture gap and expedite the process in international business development.

Our goal is to help Uganda and East African countries thrive and compete globally as a new economic powerhouse, through partnerships with American companies.

With 45 million + people in Uganda alone and growing by the second. These nations desire full employment, support educational advancement, and offer a wealth of resources and opportunities to encourage partnerships from around the world.

The needs are vast. Industry, Agriculture, Hospitality, Infrastructure and Healthcare all represent significant areas of opportunity for international partners.

Our team is located in Uganda and the United States to facilitate fast connections for launching new partnerships quickly by cutting through layers of government bureaucracy.

International businesses have been flocking to Uganda and East African Countries because of the international friendly environment, abundance of resources, and central global location.

Reaching the right governmental departments and decision makers can often be challenging for outside companies. That’s where the EAP trans-continental teamwork comes in. Together, we bridge the culture gap and expedite the process in international business development.

Our goal is to help Uganda and East African countries thrive and compete globally as a new economic powerhouse, through partnerships with American companies.

Why Africa?

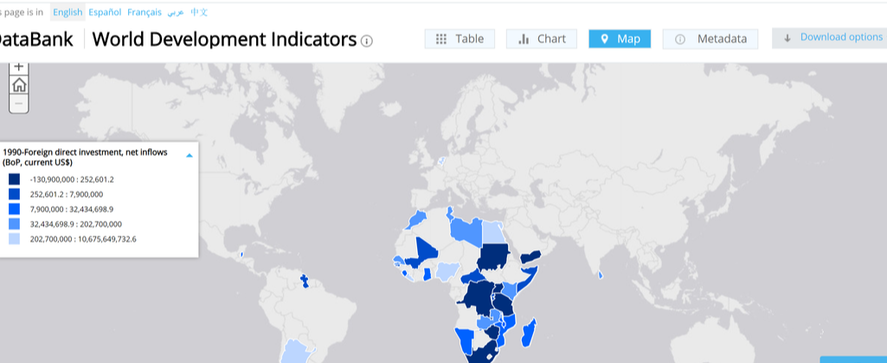

For the third year in a row, foreign direct investment (FDI) is down all over the world, but not in Africa.

Global money is banking on African growth, reduced barriers to cross-border trade and affordable access to commodities.

From 2017 to 2018, global FDI fell from $1.5 trillion to $1.3 trillion, according to an analysis by the United Nations Conference on Trade and Development (UNCTAD). The conference released its 2019 World Investment Report this week, showing that global FDI not only hit its lowest level since the global financial crisis, but has also been on the decline for three consecutive years.

One region defied this trend: Africa. In 2018, roughly $46bn worth of FDI flowed into Africa, an 11 percent increase compared to 2017. This is significant for the continent because when a company or an individual makes an FDI, they are said to be establishing a long-term business interest in a foreign country. The expectation is that they will not only invest money, but also time, and soft assets (i.e. technology, expertise and training).

Why Africa? The African Continental Free Trade Agreement (AfCFTA) was signed into law in May and allows 52 African countries to buy and sell goods without tariffs, which will make them less expensive and therefore more appealing to African consumers.

"The AfCFTA agreement will bolster regional cooperation," Mukhisa Kituyi, secretary-general of UNCTAD said. "Along with upbeat growth prospects, this bodes well for FDI flows to the continent." Commodities are the other big draw for global investors. According to UNCTAD, global money is now investing in African commodities such as gold in order to profit from expected price increases.

Sources of capital In 2017, France was the top foreign investor in Africa, followed by the Netherlands, the United Kingdom, and the United States.

Critically, UNCTAD's data shows that from 2013 to 2017, Chinese FDI in Africa grew 65 percent, only topped by the Netherlands, for which FDI was up more than 200 percent.

Global money is banking on African growth, reduced barriers to cross-border trade and affordable access to commodities.

From 2017 to 2018, global FDI fell from $1.5 trillion to $1.3 trillion, according to an analysis by the United Nations Conference on Trade and Development (UNCTAD). The conference released its 2019 World Investment Report this week, showing that global FDI not only hit its lowest level since the global financial crisis, but has also been on the decline for three consecutive years.

One region defied this trend: Africa. In 2018, roughly $46bn worth of FDI flowed into Africa, an 11 percent increase compared to 2017. This is significant for the continent because when a company or an individual makes an FDI, they are said to be establishing a long-term business interest in a foreign country. The expectation is that they will not only invest money, but also time, and soft assets (i.e. technology, expertise and training).

Why Africa? The African Continental Free Trade Agreement (AfCFTA) was signed into law in May and allows 52 African countries to buy and sell goods without tariffs, which will make them less expensive and therefore more appealing to African consumers.

"The AfCFTA agreement will bolster regional cooperation," Mukhisa Kituyi, secretary-general of UNCTAD said. "Along with upbeat growth prospects, this bodes well for FDI flows to the continent." Commodities are the other big draw for global investors. According to UNCTAD, global money is now investing in African commodities such as gold in order to profit from expected price increases.

Sources of capital In 2017, France was the top foreign investor in Africa, followed by the Netherlands, the United Kingdom, and the United States.

Critically, UNCTAD's data shows that from 2013 to 2017, Chinese FDI in Africa grew 65 percent, only topped by the Netherlands, for which FDI was up more than 200 percent.

East African Partners Code OF Ethics

This Code of Ethics was enacted by the International Business Brokers Association (IBBA). This Code of Ethics is for use by all Business Brokers as a means of establishing uniform ethical practices when providing Business Brokerage services for clients and customers. East African Partners conducts business using this same Code of Ethics.

While the Code of Ethics establishes obligations that may be higher than those mandated by law, in any instances where the Code of Ethics and the law conflict, the obligations of the law must take precedence.

PREAMBLE

Business Brokers support entrepreneurship, and the concept that the investment risks of owning a business deserve a straightforward professional and honest presentation to both Seller and Buyer.

This Code of Ethics imposes obligations beyond those of ordinary commerce. Business Brokers should be zealous in maintaining and improving ethical practices and sharing with their fellow Business Brokers a common responsibility for integrity and honor in their business transactions.

In recognition and appreciation of their obligations to clients, customers, the public, and each other, Business Brokers should continuously strive to become and remain informed on issues affecting the sale of businesses, and be willing to share their experience with others. Business Brokers should strive to eliminate practices which may damage the public or which might discredit or bring dishonor to the Business Brokerage profession.

Business Brokers should urge sole and exclusive representation of clients, not attempt to gain any unfair advantage over competitors, and refrain from making unsolicited comments about other practitioners.

Business Brokers should pledge to observe the spirit of this Code of Ethics in all of their activities and to conduct their business in accordance with the tenets set forth below:

Article 1

Business Brokers should avoid exaggeration, misrepresentation, or concealment of pertinent facts relating to properties and business transactions; however, nothing herein shall be construed to obligate Business Brokers to discover latent defects, to advise on matters outside the scope of their expertise, or to disclose facts which are confidential under the scope of agency duties owed to their clients.

Article 2

Business Brokers should make a reasonable effort to protect the public and all parties in a transaction against fraud, misrepresentation, or unethical practices in the area of business opportunity transactions.

Article 3

Business Brokers should not discourage or prevent customers and clients from seeking the services of attorneys, accountants, or other professional advisors.

Article 4

Business Brokers should keep in a special bank account, separated from their own funds, monies coming into their possessions in trust for other persons.

Article 5

Business Brokers should obtain terms and conditions of agreements in writing regarding business opportunity transactions and ensure that copies of such agreements are given to all parties involved.

Article 6

Business Brokers, in accepting employment as agents, should pledge to protect and promote the interests of their clients. This obligation of absolute loyalty and honesty to the client’s interest is primary, but it does not relieve Business Brokers from the obligation of dealing fairly with all parties to business opportunity transactions.

Article 7

Business Brokers accepting compensation from more than one party should make disclosure to the principals of the transaction.

Article 8

Business Brokers serving as both an agent and principal should disclose the dual agency relationship to the principals of the transaction.

Article 9

Business Brokers having a present or contemplated interest concerning a business property or its value should disclose such interest to the principals of the transaction.

Article 10

Business Brokers, acting as an agent, accepting any commission, rebate, or profit due to expenditures made on behalf of the principal should disclosure and obtain consent from the principal.

Article 11

Business Brokers undertaking to provide specialized services concerning a type of property or a service outside their field of competence should disclose such facts, or engage the assistance of one who is competent on such types of property or service. Any persons engaged to provide such assistance should be so identified to the client and their contribution to the assignment should be set forth.

Article 12

Business Brokers should only advertise business opportunities as being for sale when they have written authority. All offerings or promotions of business opportunities should reflect the terms consistent with those in writing with the client.

Article 13

All written offers will be submitted to the client unless otherwise directed by the client.

Article 14

Business Brokers will not engage in the practice of disclosing the terms of one Buyer’s offer to another Buyer.

Article 15

Business Brokers shall not deny equal access of professional services to any person for reasons of race, color, religion, sex, handicap, familial status, or national origin. Business Brokers shall not be a party to any plan or agreement to discriminate against a person or persons on the basis of race, color, religion, sex, handicap, familial status, or national origin.

While the Code of Ethics establishes obligations that may be higher than those mandated by law, in any instances where the Code of Ethics and the law conflict, the obligations of the law must take precedence.

PREAMBLE

Business Brokers support entrepreneurship, and the concept that the investment risks of owning a business deserve a straightforward professional and honest presentation to both Seller and Buyer.

This Code of Ethics imposes obligations beyond those of ordinary commerce. Business Brokers should be zealous in maintaining and improving ethical practices and sharing with their fellow Business Brokers a common responsibility for integrity and honor in their business transactions.

In recognition and appreciation of their obligations to clients, customers, the public, and each other, Business Brokers should continuously strive to become and remain informed on issues affecting the sale of businesses, and be willing to share their experience with others. Business Brokers should strive to eliminate practices which may damage the public or which might discredit or bring dishonor to the Business Brokerage profession.

Business Brokers should urge sole and exclusive representation of clients, not attempt to gain any unfair advantage over competitors, and refrain from making unsolicited comments about other practitioners.

Business Brokers should pledge to observe the spirit of this Code of Ethics in all of their activities and to conduct their business in accordance with the tenets set forth below:

Article 1

Business Brokers should avoid exaggeration, misrepresentation, or concealment of pertinent facts relating to properties and business transactions; however, nothing herein shall be construed to obligate Business Brokers to discover latent defects, to advise on matters outside the scope of their expertise, or to disclose facts which are confidential under the scope of agency duties owed to their clients.

Article 2

Business Brokers should make a reasonable effort to protect the public and all parties in a transaction against fraud, misrepresentation, or unethical practices in the area of business opportunity transactions.

Article 3

Business Brokers should not discourage or prevent customers and clients from seeking the services of attorneys, accountants, or other professional advisors.

Article 4

Business Brokers should keep in a special bank account, separated from their own funds, monies coming into their possessions in trust for other persons.

Article 5

Business Brokers should obtain terms and conditions of agreements in writing regarding business opportunity transactions and ensure that copies of such agreements are given to all parties involved.

Article 6

Business Brokers, in accepting employment as agents, should pledge to protect and promote the interests of their clients. This obligation of absolute loyalty and honesty to the client’s interest is primary, but it does not relieve Business Brokers from the obligation of dealing fairly with all parties to business opportunity transactions.

Article 7

Business Brokers accepting compensation from more than one party should make disclosure to the principals of the transaction.

Article 8

Business Brokers serving as both an agent and principal should disclose the dual agency relationship to the principals of the transaction.

Article 9

Business Brokers having a present or contemplated interest concerning a business property or its value should disclose such interest to the principals of the transaction.

Article 10

Business Brokers, acting as an agent, accepting any commission, rebate, or profit due to expenditures made on behalf of the principal should disclosure and obtain consent from the principal.

Article 11

Business Brokers undertaking to provide specialized services concerning a type of property or a service outside their field of competence should disclose such facts, or engage the assistance of one who is competent on such types of property or service. Any persons engaged to provide such assistance should be so identified to the client and their contribution to the assignment should be set forth.

Article 12

Business Brokers should only advertise business opportunities as being for sale when they have written authority. All offerings or promotions of business opportunities should reflect the terms consistent with those in writing with the client.

Article 13

All written offers will be submitted to the client unless otherwise directed by the client.

Article 14

Business Brokers will not engage in the practice of disclosing the terms of one Buyer’s offer to another Buyer.

Article 15

Business Brokers shall not deny equal access of professional services to any person for reasons of race, color, religion, sex, handicap, familial status, or national origin. Business Brokers shall not be a party to any plan or agreement to discriminate against a person or persons on the basis of race, color, religion, sex, handicap, familial status, or national origin.